529 Plan Rules Room Board

A student does not have live on campus or in college approved housing for room and board to qualify as an education expense.

529 plan rules room board. Required textbooks and supplies. You can use a 529 plan distribution to pay for a student s room and board expenses if the student is enrolled at least half time. Using your 529 plan to pay for room and board room and board costs make up a large portion of a student s total college bill second only to tuition. Room and board includes the cost of housing and the cost of a meal plan.

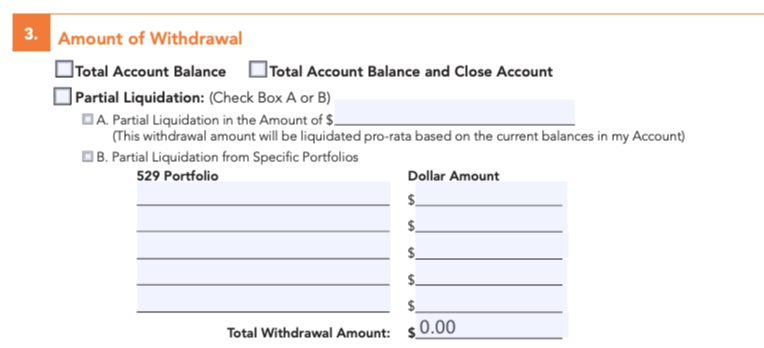

The room and board expenses must be incurred while the student is enrolled at a college or university that is eligible for title iv federal student aid. If you plan to use your 529 plan to pay for room and board you should meet the following criteria. Using 529 college savings plan money for part time students even room and board counts as an eligible expense for half time students. Your state s plan best 529 plans of 2020 compare 529 plans complete guide to 529 plans enroll in a 529 plan top 10 performance rankings 5 cap ratings 529 plan investment options 529 fee study 529 able accounts find a 529 pro newsletters 529 news.

Tuition and fees are considered required expenses and are allowed but when it comes to room and board the costs can t exceed the greater of the following 2 amounts. The caveat here is that your off campus housing costs can t be higher than you d pay to live on campus if you want to use 529 funds. Room and board whether you live on campus or off you can use your 529 plan spending for your room and board expenses. Room and board costs may be treated as qualified education expenses for 529 plan distribution purposes if the student is enrolled at least half time by the standards of the school.

Finally to reiterate what i ve said above in order to claim room and board costs those costs must have been incurred in direct support of the education. And the college doesn t have to be a four year institution. So if the student was not enrolled in classes for the summer months then not one single penny of room and board costs for those months can be claimed against the 529 funds. Yes the cost of off campus room and board may be a qualified education expense for 529 plans if certain criteria are met.

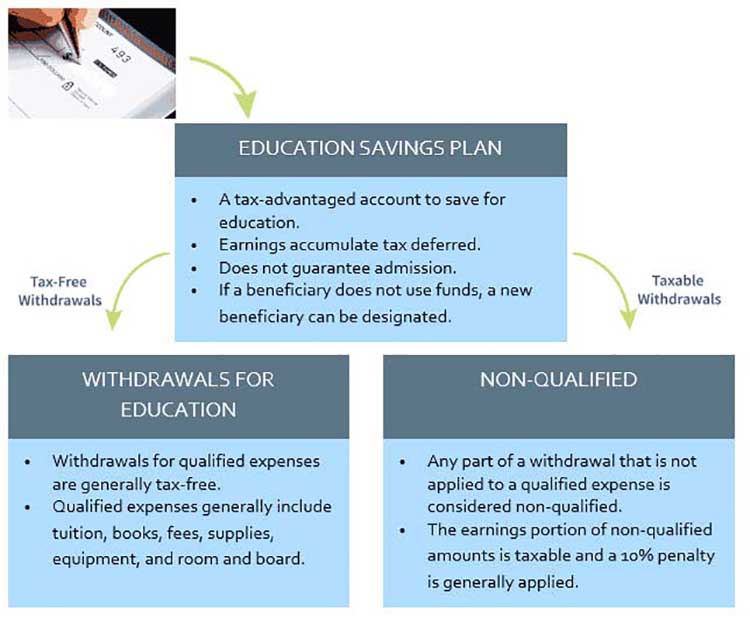

You can use a 529 plan to pay for room and board but only if certain requirements are met.